The New Indian Youth Investor: Navigating the Digital Rush

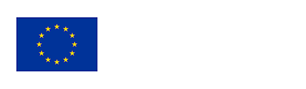

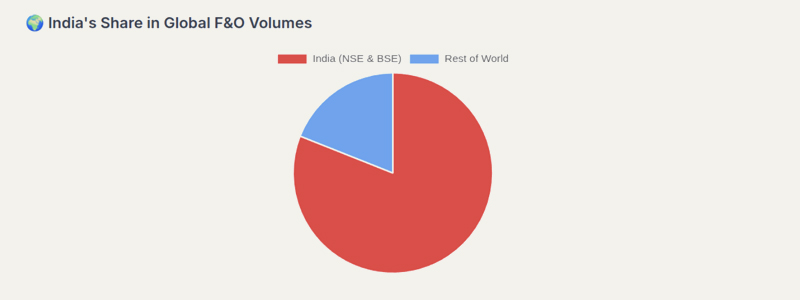

Ever since the pandemic, something big has been happening in India’s financial world. A new generation of young people is jumping into the stock market, driven by ambition and a desire for financial freedom. Thanks to super-easy trading apps and social media, investing is no longer just for older, wealthy folks. But with this rush comes a major challenge: a wild, unregulated world of "finfluencers" and get-rich-quick scams. Let's look at the numbers. Data from the National Stock Exchange shows that investors under the age of 30 now make up about 40% of all new demat accounts opened in India. That’s a huge shift. But here's the catch: many of these young investors are getting their financial advice from YouTube and Telegram, not from certified professionals. They're seeing influencers flaunt lavish lifestyles and promise quick returns, creating a serious case of FOMO—the fear of missing out. This often leads them down a risky path, especially into high-stakes, high-leverage trading like Futures & Options (F&O), with reports suggesting that India’s share in Global F&O volume is as high as 81%. That is a serious number.

It's a tough lesson to learn. A study by the Securities and Exchange Board of India (SEBI) found that nearly 9 out of 10 individual traders in the F&O segment actually lose money. The average loss can be significant, highlighting just how dangerous this can be when you're following bad advice. What makes this problem uniquely Indian is the sheer scale. Our F&O market volumes have grown so much that they make up a massive portion of the global total. While this shows incredible market participation, it also means a lot of young, vulnerable investors are caught in this high-risk game.

Thankfully, the government isn't just watching this happen. The Securities and Exchange Board of India (SEBI) has been taking proactive steps to clean up this digital space. They've cracked down on unregistered financial advisors and put new rules in place to stop misinformation. But their best tool might be education. SEBI-founded institutions, like the National Institute of Securities Markets (NISM), are doing fantastic work by offering free online courses like “Financial Literacy Course for Bharat”. Anyone can get started with the basics of investing, learn about market risks, and understand how to spot a scam—all for zero cost. It's a powerful way to equip young people with the right knowledge to protect themselves. In the end, while technology has opened up a world of opportunity, it's also brought new dangers. We, as young people, have to be smarter about where we get our advice. The journey to building real wealth isn't a race; it's a marathon that requires patience and solid knowledge. The right tools are out there—it's up to us to choose education over easy promises.

By Sudipta Ganguly, WSA Youth Ambassador in India.

Sources

● Gen Z bulls: Young investors dominate market, half under 30 - The Hindu BusinessLine

● SEBI & NISM Initiatives: NISM official website and press releases

● Red Flags To Watch Out For Before Taking Advice From Finfluencers